The Facts About Estate Planning Attorney Revealed

The Facts About Estate Planning Attorney Revealed

Blog Article

Estate Planning Attorney for Dummies

Table of ContentsThe Only Guide for Estate Planning AttorneyAll about Estate Planning AttorneyHow Estate Planning Attorney can Save You Time, Stress, and Money.Some Known Questions About Estate Planning Attorney.

Estate planning is an action plan you can use to determine what happens to your assets and obligations while you live and after you pass away. A will, on the various other hand, is a lawful record that outlines how assets are dispersed, that cares for youngsters and pets, and any various other dreams after you pass away.

The executor likewise has to pay off any type of tax obligations and debt owed by the deceased from the estate. Creditors normally have a minimal amount of time from the date they were informed of the testator's fatality to make cases against the estate for money owed to them. Claims that are turned down by the administrator can be brought to justice where a probate court will have the final say as to whether or not the insurance claim is legitimate.

Top Guidelines Of Estate Planning Attorney

After the supply of the estate has actually been taken, the value of assets calculated, and tax obligations and financial debt repaid, the executor will after that look for permission from the court to distribute whatever is left of the estate to the beneficiaries. Any estate tax obligations that are pending will certainly come due within nine months of the date of fatality.

Each specific areas their properties in the trust fund and names a person other than their spouse as the recipient., to sustain grandchildrens' education.

The Greatest Guide To Estate Planning Attorney

Estate planners can collaborate with the donor in order to minimize taxable revenue as a result of those payments or formulate methods that take full advantage of the result of those donations. This is an additional technique that can be made use of to limit fatality tax obligations. find more info It involves a specific locking in the present worth, and thus tax responsibility, of their residential property, while attributing the value of future development of that resources to another individual. This approach involves freezing the worth of a property at its value on the date of transfer. As necessary, the quantity of potential funding gain at fatality is likewise frozen, enabling the estate organizer to approximate their potential tax obligation upon fatality and far better prepare for the payment of earnings tax obligations.

If enough insurance earnings are readily available and the plans navigate to this website are properly structured, any earnings tax on the considered personalities of properties adhering to the fatality of a person can be paid without considering the sale of assets. Proceeds from life insurance policy that are gotten by the beneficiaries upon the death of the insured are normally earnings tax-free.

Other charges connected with estate planning consist of the preparation of a will, which can be as low as a couple of hundred bucks if you make use of one of the best online will certainly manufacturers. There are particular records you'll require as component of the estate preparation process - Estate Planning Attorney. A few of the most common ones include wills, powers of lawyer (POAs), guardianship classifications, and living wills.

There is a misconception that estate preparation is only for high-net-worth people. Estate preparing makes it easier for people to identify their wishes prior to and after they die.

Some Known Facts About Estate Planning Attorney.

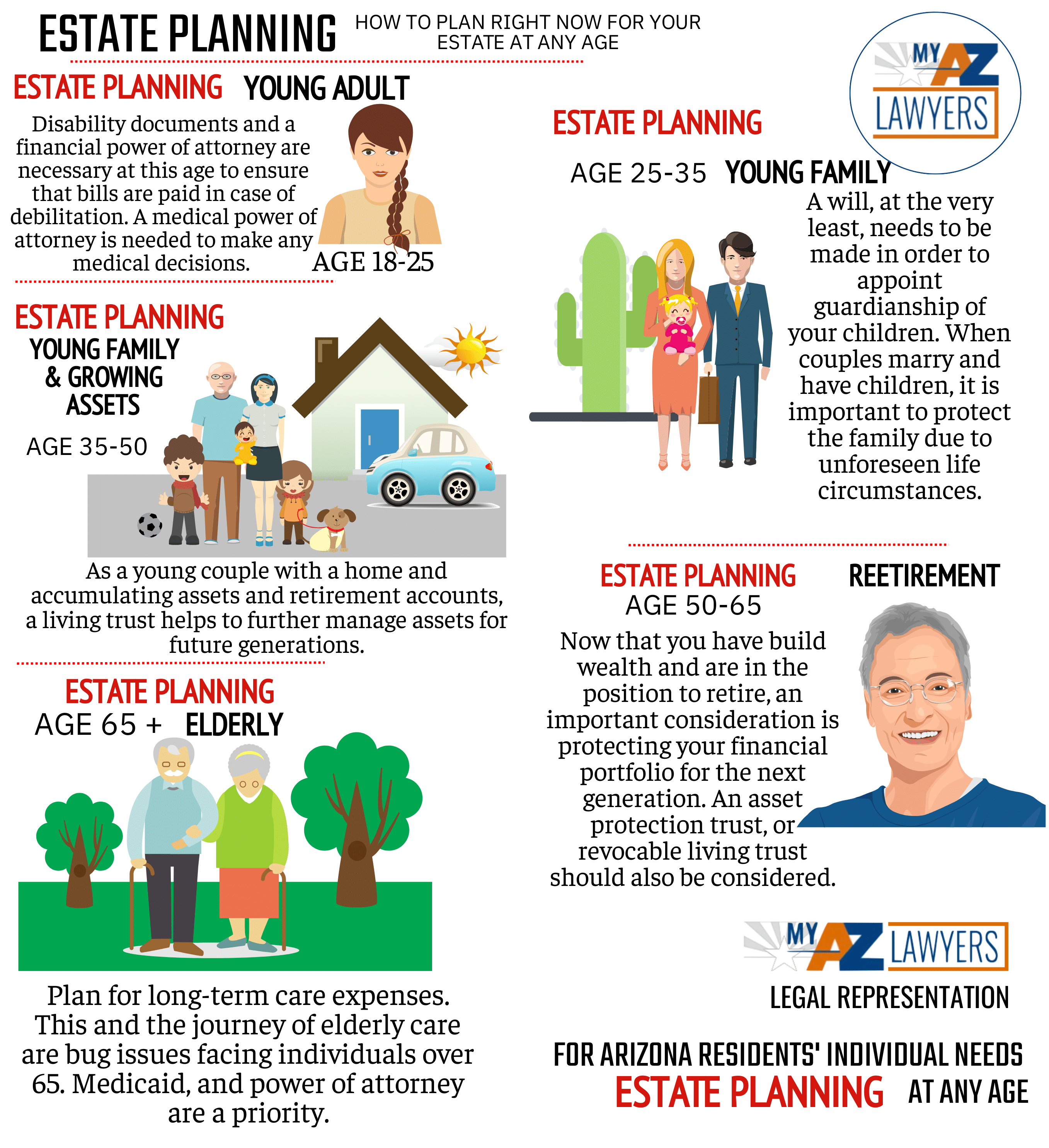

You should start preparing for your estate as soon as you have any type of measurable property base. It's a continuous process: as life progresses, your estate plan ought to change to match your circumstances, in line with your brand-new objectives.

Estate planning is typically taken a device for the wealthy. That isn't the instance. It can be a valuable way for you to handle your possessions and obligations prior to and after you pass away. Estate preparation is additionally a great way for you to lay out plans for the care of your minor kids and family pets and to describe your desires for your funeral and preferred charities.

Qualified candidates that pass the exam will be officially accredited in August. If you're qualified to use this link rest for the test from a previous application, you might submit the short application.

Report this page